All about Pacific Prime

In the United States, health and wellness insurance is a voluntary issue, yet several people are involuntarily without protection. There is no assurance for a lot of individuals under the age of 65 that they will be eligible for or able to afford to purchase or preserve medical insurance. Practically seven out of every 10 Americans under age 65 years are covered by employment-based wellness insurance policy, either from their job or with a moms and dad or partner.

A modification in insurance policy costs or terms, in addition to changes in revenue, wellness, marital status, regards to employment, or public policies, can cause a loss or gain of medical insurance coverage. For concerning one-third of the without insurance population, being without coverage is a temporary or single disruption of protection, and the average period of a duration without insurance coverage is between 5 and 6 months.

The 8-Second Trick For Pacific Prime

Given that the mid-1970s, growth in the price of medical insurance has actually outpaced the rise in real earnings, creating a gap in buying capacity that has actually included roughly one million persons to the rankings of the uninsured annually. expat insurance. Despite the economic prosperity of current years, in between 1998 and 1999 there was just a slight decrease in the numbers and percentage of without insurance Americans

Given that the mid-1990s, increases in employment-based protection have been balanced out by consistent or decreasing prices of public and individually bought insurance coverage. * Entirely, concerning 83 percent of the nonelderly population is covered by employment-based, specific and public strategies. Some individuals report even more than one resource of coverage over the program of a year.

The clergy and various other religious employees make up the largest single group of individuals without ties to Social Safety and Medicare. 3In 1996, the CPS estimate of the variety of nonelderly individuals uninsured was 41 million (Fronstin, 2000a) (https://yoomark.com/content/we-are-award-winning-insurance-intermediary-choice-simplifying-world-insurance-help-you-find).4 The federal Emergency situation Medical Treatment and Active Labor Act, component of the Consolidated Omnibus Budget Reconciliation Act of 1985, calls for medical facility emergency spaces to analyze and maintain all patients with a life- or limb-threatening or emergency clinical condition or those who are about to give birth

About Pacific Prime

Employers frequently provide health insurance policy, and often life insurance and handicap insurance, as an office benefit. When you acquire insurance policy through a company, you might have an option of one or even more strategies that your employer has pre-selected and your employer may pay some or all of the costs for your insurance coverage.

Captive insurance refers to a subsidiary company developed to give insurance to the parent business and its associates. A restricted insurance policy firm represents an option for numerous companies and teams that wish to take financial control and handle dangers by financing their very own insurance as opposed to paying premiums to third-party insurance providers.

The Ultimate Guide To Pacific Prime

Actually, for numerous years currently, Vermont has actually rated as the leading captive domicile in the United States and in 2022 ended up being the number one-ranked residence globally. Vermont's success to date can be credited to a combination of factors, not the least of which is the ongoing management of Vermont's Governors, both previous and existing, and both homes of the State Legislature that remain to maintain Vermont's historical tradition of providing solid support for this state's captive market

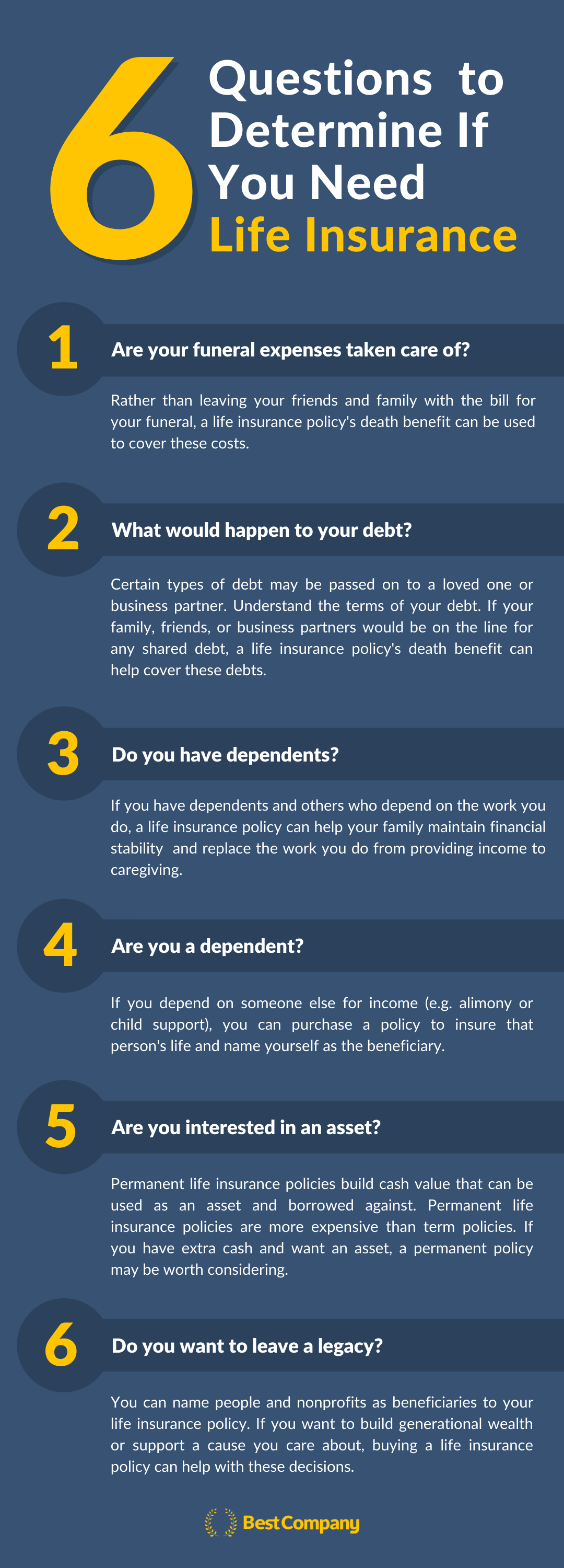

Lots of New Yorkers spend substantial amounts of cash annually on life insurance policy costs with extremely little idea of what they are getting for their cash - international health insurance. Often customers do not realize that there are significant distinctions in the sorts of life insurance policy they can buy and the sources for such coverage

:max_bytes(150000):strip_icc()/homeowners-insurance-guide_final-88e7d3469dcc4920977498f08564b234.png)